工厂介绍

five below, inc. (five)

by:Keke Jewelry

2019-10-26

Washington, D. C. Securities and Exchange CommissionC. 20549Form 10-

Annual Report submitted under Section 13 or 15 (d)

Pursuant to section 13,15, the Securities Trading Act or transition report for the fiscal year 1934 ended January 28, 2017 (d)

Provisions of the Securities Trading Act of 1934 on the transition period from tocommsion File Number: 001-

Below 35600, the company(

The exact name of the registrant specified in the articles of association)Pennsylvania75-3000378(

State or other jurisdiction of company or organization)(I. R. S.

Employee Identification Number)

1818 Market Street suites 2000 Philadelphia, PA 19103 (

Main executive office address)19103(Zip Code)(215)546-7909(

Registrant phone number, including area code)

Securities registered under article 12 (b)

The trading act: the title of each class name of each exchange registered with common stock, $0.

01 Nasdaq Stock Market LLCSecurities registered under section 12th (g)

Securities trading law: the person who changed the check mark of registeredNot appliclenot applicableIndicate for each topic is

Well-known experienced issuers as defined in Rule 405 of the Securities Act.

Is it not necessary to submit a report under Section 13 or section 15 (d)of the Act.

Indicate by check mark whether the registrant (1)

All reports requested by Article 13 or 15 have been submitted (d)

Securities Trading Act of 1934 within the first 12 months (

Or a short period of time required for the registrant to submit such reports), and (2)

This filing requirement has been bound for the last 90 days.

Indicate by check mark whether the registrant has electronically submitted and posted on his company\'s website, if any, every interactive data submitted and posted under S-Regulation section 405thT (§232.

This Chapter 405)

Within the first 12 months (

Or in such a short time that the registrant is required to submit and publish these documents).

Disclosure under S-Regulation section 405th whether the declarant in arrears is indicated by a check markK (§ 229. 405)

As the registrant is aware, it is not included here and will not be included in the final proxy or information statement referenced in Part 3 of this form --

K or any amendments to this form 10K.

Indicate by check mark whether the registrant is a large accelerated declarant, a non-accelerated declarant

A smaller reporting company.

See the definition of \"large accelerated file manager\", \"accelerated file manager\" and \"small Reporting Company\" in rule 12b

2 of the Trading Act. (Check one)

: Non-accelerated files for big acceleration

Indicate whether the registrant is a shell company by check mark (

Defined in Rule 12b-

2 parts of the transaction law).

On July 29, 2016, the last working day of the second fiscal quarter recently completed by the registrant, the total market value of ordinary shares (

According to the last reported sales price on Nasdaq\'s Global Select Market)held by non-

The registrant\'s affiliates are approximately $2,449,890,478.

The number of shares of the registrant\'s common stock, $0.

The face value of 01 was 930,387 outstanding as of March 22, 2017.

Documents incorporated in the reference section of the registrant\'s proxy statement for the 2017 General Meeting of Shareholders held in june20 on 2017 (

Hereinafter referred to as \"agency Statement \")

Included as a reference in part III of this report.

Special note on forwarding

Annual Report on Form 10

The annual report contains forward-looking

Statements are made under the \"safe harbor\" provisions of the Private Securities Litigation Reform Act of 1995. Forward-

Forward-looking statements relate to expectations, beliefs, forecasts, future plans and strategies, anticipated events or trends, and similar expressions of matters concerning non-historical facts or current facts or conditions, for example, statements about our future financial position or results of operations, prospects and strategies for our future growth, the launch of new goods, and the implementation of our marketing and brand strategy.

In many cases, you can identify the forward

Statements in terms such as \"possible\", \"will\", \"should\", \"expected\", \"plan\", \"expected\", \"believe\", \"estimate, \"Prediction\", \"potential\" or negation of these terms or other similar terms. The forward-

The forward-looking statements in this annual report reflect our views on future events and are affected by risks, uncertainties, assumptions and changes that may cause events or our actual activities or results to be significantly different from the assumptions and situation changes expressed in any forwarding

Statement.

Despite our belief, the expectations reflected in the future

We cannot guarantee future events, results, actions, level of activity, performance or achievements.

Many important factors may lead to significant differences in actual results from the results indicated previously

Part I, Item 1A, \"risk factors\" and forward-looking statements described in Part II, including, but not limited to, the following factors, Item 7 \"Management\'s Discussion and Analysis of the financial position and results of operations.

These factors include but are not limited to: failure to implement our growth strategy successfully;

Our ability to select, acquire, distribute and sell goods is disturbed;

Dependent on goods produced outside the United States;

Depends on the passenger flow of our store;

Failure to attract and retain qualified employees;

The capacity of our distribution network cannot be expanded successfully;

Our distribution network breaks down or receives inventory in a timely manner;

Extreme weather conditions in the area where our store is located may have a negative impact on our business and operational results;

Failure to protect the client\'s confidential or credit card information, or other private data relating to our employees or the company;

Increased operating costs due to customer payments or face fraud or theft-related risks;

Unable to increase sales and increase efficiency, cost and efficiency of operations;

Reliance on or inability to employ additional qualified personnel for our executives, senior management and other key personnel;

Unable to manage our inventory balance and inventory shrinkage successfully;

Our lease obligations

Changes in our competitive environment, including increased competition from other physical retailers and online retailers;

Increased costs due to inflation, increased operating costs, higher wage rates or higher energy prices;

Seasonal nature of our business;

Unable to successfully expand our business to online retail;

Interrupt our information technology system during normal process or due to system upgrade;

Insufficient internal control is not maintained;

The complexity of the design or implementation of new enterprise resource systems;

Natural disasters, bad weather, outbreak of pandemic diseases, global political events, war and terrorism;

Current Economic Situation and other economic factors;

Influence of government laws and regulations;

Costs and Consequences of legal proceedings;

We cannot protect our brands, trademarks and other intellectual property rights;

Effects of product and food safety claims and effects of legislation;

Additional financing is not available if required;

The constraints that our debt imposes on our current and future business;

Regulations related to conflict minerals.

In assessing the future, readers are urged to consider these factors carefully

Forward-looking statements and are warned not to rely too much on them

Look at the report.

All the strikers.

The forward-looking statements we include in this annual report are based on the information provided on the date of this report.

We have no obligation to update or modify any forwarding publicly-

Forward-looking statements, whether due to new information, future events or other reasons, unless otherwise required by law.

Index part IPageITEM 1.

Business 1A.

Risk factor 1B.

Unresolved employee reviews 2.

Property item month.

Legal action 4.

The third part is the fifth mine safety disclosure.

Market for registrant common stock, related shareholder matters and issuer to purchase equity securities

Selected Financial Data Items 7.

Management\'s Discussion and Analysis of operating conditions and results

Quantitative and qualitative disclosure of market risks

Consolidated financial statements and supplementary data item 9.

Changes and disagreements with accountants on accounting and financial disclosure project 9A.

Control and procedure 9B.

Section IIIITEM 10 of other information.

Project 11. Director, executive officer and corporate governance.

Item 12 of administrative compensation.

Secured ownership of certain beneficial owners and management and related shareholders.

Relationship with directors and related transactions.

Main accounting fees and services section IVITEM 15.

Annex and schedule 16 to the financial statements. FORM 10-

Item ysignaturespart IITEM 1.

The following companies

Founded in Pennsylvania in January 2002.

Our main executive office is located at 1818 Market Street, PA 2000 suite 19103, Philadelphia, and our telephone number is (215)546-7909.

The address of our company website isfivebelow. com.

Information contained on or accessible through our company\'s website does not form part of this annual report.

As described in this article, \"the following five\", \"company\", \"our\" or \"our business\" refer to the following five companies(

Co-owned with wholly owned subsidiaries)

, Unless explicitly indicated or otherwise required by context.

We buy products based on existing market trends, so call our products \"trend-right.

\"We use the term\" dynamic \"merchandise to refer to the wide range and often changing nature of the products we display in the store.

We use the term \"electric power\" mall to refer to a shopping mall that is not closed and has a total area of 250,000 to 750,000 square feet of rentable

Large retailers with an area of over 50,000 square feet)

A variety of small retailers sharing a parking lot with retailers.

We use the term \"lifestyle\" shopping center to refer to a shopping mall or business development that is usually located in the suburbs, which combines the traditional retail functions of the shopping center with the high-end consumers.

We use the term \"community\" shopping center to refer to a shopping district that is designed to serve a trade zone of 40,000 to 150,000 people, with major tenants enjoying various discounts, junior department stores and/or supermarkets.

We use the term \"trade zone\" to refer to the geographic area from which most customers of a given retailer come from.

The trade area varies depending on geographical area, population density, population structure and other shopping opportunities nearby.

We run on the financial calendar that is widely used in the retail industry, which leads to-or 53-

Closest to the week ending on Saturday, January 31 of the following year.

\"Fiscal Year 2017\" or \"Fiscal Year 2017\" refers to the period from January 29-20, 2017 to February 3, including 53-

Fiscal year week

\"Fiscal Year 2016\" or \"Fiscal Year 2016\" refers to the period from January 31-20, 2016 to January 28, including 52-

Fiscal year week

\"Fiscal Year 2015\" or \"Fiscal Year 2015\" refers to the period from February 1-20, 2015 to January 30, including 52-

Fiscal year week

\"Fiscal Year 2014\" or \"Fiscal Year 2014\" refers to the period from February 2-20, 2014 to January 31, including 52-

Fiscal year week

\"Fiscal Year 2013\" or \"Fiscal Year 2013\" refers to the period from February 3-20, 2013 to February 1, including 52-

Fiscal year week

\"Fiscal Year 2012\" or \"Fiscal Year 2012\" refers to the period from January 29-20, 2012 to February 2, including 53-

Fiscal year week

Unless otherwise stated, the references to 2016, to, in, to, twitter 3, and 12 are our fiscal year.

Below 5 of our company is a fast-growing professional value retailer that offers a wide range of trendsright, high-

Quality goods for teenagers and teenagersteen customer.

We offer a variety of exciting products at a price of $5 and below, including selected brands and licensed goods in our many categories of the world: style, room, sports, technology, crafts, parties, candy and now.

We believe that we are working through unique sales strategies and

Our customers see interesting and exciting energy retail concepts.

Based on management experience and industry knowledge, we believe that our compelling value proposition and the dynamic nature of our products cultivate the universal appeal of adolescents and adolescents

In addition to our target population, teenagers and customers in various age groups.

In 2002, we opened the first of the following five stores in the greater Philadelphia area, and since then we have been expanding in the northeastern, southern, and central and western parts of the United States.

As of 2017, we have operated a total of 5 22 locations in 31 states.

Our new store model assumes that the store area is approximately 8 000 square feet and is usually located within the power, community and lifestyle shopping centers in various cities, suburbs and semi-suburbsrural markets.

We have opened 85 new net stores in fiscal2016 and are planning to open about 100 new stores in fiscal207.

We believe that over time we have the opportunity to expand our store base to more than 2 thousand locations.

In August 2016, we started selling goods on the Internet through our fivebelow. com e-

Business website.

We launched our electronics.

Business operations as an additional channel to serve our customers.

We believe that our business model brings strong financial performance regardless of the economic environment: our comparable sales have tripled.

0% in fiscal, 2016, 3.

4% in fiscal2015, and3.

4% in fiscal204.

We expanded our store base from 36 stores at the end of the fiscal year to 5 stores at the end of the fiscal year, which represents a compound annual growth rate of 19 years. 4%.

Our net sales increased from $680 to 14.

$2 million to $1,000.

Compound annual growth rate of 4 million. 3%.

During the same period, our operating income increased from $77.

Between $114 and $.

Compound annual growth rate of 0 million. 6%.

Our competitive advantage we believe that the following five advantages, unlike our competitors, are the key drivers of our success: a unique focus on youth and adolescentsTeen Customer.

Our goal is for young people and an attractive customer base.

Teenagers with trends

The right item at different prices of $5 and below.

We have established the concept of attracting this customer base, and based on our industry knowledge and experience, we believe that this customer base is economically influential and resilient, and their parents and others who shop for them.

Our brand philosophy, sales strategy and store atmosphere work together to create an optimistic and dynamic retail experience designed to attract our target audience and drive traffic in our stores, keep our customers active throughout the visit.

We have been monitoring trends.

Change teenagers and former

Be able to quickly identify and respond to trends that become mainstream.

Our price makes teens and pre-

Teenagers shop independently and often use their own money to buy goods mainly for them and exercise themselves

Expressed through their independent retail purchases.

Various trendsRight, High-

Quality goods with universal appeal.

We offer edited trends

Like everyday products in our world of each category, these products are constantly changing to generate a sense of expectation and freshness that we think provides excitement for our customers.

We have a large number of suppliers, most of which are domestic.

Enables us to shorten response lead times, maximize our market speed, and enable us to make more informed purchasing decisions.

Our unique approach encourages frequent customer visits and limits the cyclical fluctuations experienced by many other professional retailers.

The breadth, depth and quality of our portfolio and the diversity of our category world attract shoppers of different ages and social ranges

Economic population statistics

Provide superior value proposition for customers.

We believe that we provide clear value proposition for our customers.

Our price points of $5 and below resonate with our target population and other values-

Customer oriented.

We are able to achieve this value proposition by purchasing products that are designed to achieve low cost, fast response and high Project speed and sell-through.

We maintain a dynamic partnership with our supplier partners, which provides us with a favorable opportunity to obtain high-quality goods at attractive prices.

We also adopt opportunistic buying strategies that take advantage of some of our excess inventory opportunities with suppliers.

This unique and flexible procurement strategy enables us to provide high

In all of our categories, quality products are of extraordinary value.

Differentiated shopping experience.

We believe that we have created a unique

The store and online atmosphere that customers find interesting and exciting.

When we update our products frequently, we keep the same floor layout, the design is simpleto-

Navigation track flow and featured landscape-

The product line throughout the store enables customers to easily identify our category world.

All of our stores have a sound system that plays the trend

There is the right music for the whole shopping day.

We present our products with novel and dynamic technologies, including unique commodity fixtures and brightly colored, stimulating signage.

This way makes our store a destination and encourages hands-on

Interact with our products and communicate our value pricing.

We have formed a unique culture that comes from our employees, many of whom often shop in the five places below, thus driving a higher level of connectivity and engagement.

In addition, we believe that our price points of $5 and below, coupled with our dynamic sales approach, create elements that discover, drive repeat access, and engage customers.

Strong and consistent store economy.

We have a proven store model that generates strong cash flow

High level of financial performance, high return on investment.

Our stores have been successful in different geographical areas, population density and real estate environments, with an average return period of less than one year for our new stores.

We believe in our strong store model through our strict site selection process and in-

Store execution, driving the intensity and consistency of our comparable sales financial results across all geographic areas and storesyear classes.

Experienced and passionate senior management team with good track record.

Our senior management team is led by our executive chairman, Thomas Velios, and our President and CEO, Joel Anderson, rich retail experience in a wide range of areas including sales real estate, finance, store operations, supply chain management, information technology.

Our management team drives our operational philosophy based on continuous focus on delivering high

High quality goods and excellent shopping experience, low use of discipline

Cost operation and procurement structure.

We believe that our management team is indispensable to our success and has positioned us for a long time. term growth.

We believe that we can increase net sales and revenue by implementing the following strategy: expand our store base.

We believe that over time, we have a great opportunity to expand our store base in the United States from 2017 locations to 2,000 locations.

According to our store compaction strategy, we expect most of our close

Both our existing market and our new market will grow in the long term.

This strategy allows us to benefit from increased brand awareness and operational efficiency.

We opened 71 net new stores in fiscal2015, 85 net new stores in fiscal2016, and plan to open about 100 new stores in fiscal207.

Our new store model assumes an area of about 8 000 square feet, mainly in-

The location of the lines within the power, community and lifestyle shopping center, spanning a variety of cities, suburbs and semi-rural markets.

We have a talented, disciplined real estate management team and a rigorous real estate site selection process.

We analyze the demographics of the surrounding trade area and the performance of the neighboring retailers, as well as the traffic and specific site features and other variables.

As of 2017, we have signed a lease agreement to open 67 new stores in fiscal207.

Drive comparable sales.

We hope to continue to create positive comparable sales growth by continuing to improve our dynamic merchandise sales products and differentiated products

Shop shopping experience.

We intend to increase our brand awareness through cost

Effective marketing work and enthusiastic customer engagement.

We believe that implementing these strategies will increase the size and frequency of purchases from our existing customers and attract new customers to our stores.

Increase brand awareness. We have a cost-

Design effective marketing strategies to promote store traffic and enhance brand awareness.

Our strategy includes leveraging newspapers, television, digital and grassroots marketing to support existing and new market access.

We take advantage of growing e-commerce

The presence of Mail databases, mobile websites and social media to drive brand excitement and increased store visits in existing and new markets.

We believe that our digital experience is an extension of our brand and retail stores and a tool for our marketing and customer engagement.

Our digital experience allows us to continue to increase brand awareness and expand our customer base.

Increase operating profit.

We believe that we have more opportunities to drive profit margins over time.

A major driver of our expected profit expansion will come from leveraging our cost structure as we continue to increase our store base and drive average net sales per store for us.

With the growth of our business and the further realization of economies of scale, we intend to take advantage of the opportunities in the supply chain.

Our history the company was incorporated in Pennsylvania in January 2002 in the name of a cheap holding company.

David Schlesinger and Thomas Vellios recognize that the market needs an interesting and affordable shopping destination for our target customers.

We changed our name to five below. in August 2002.

In July 2014, Joel Anderson joined the five senior management teams below.

Joel Anderson was appointed Executive President on December 2014, and Thomas Velios was appointed executive chairman, both of which came into effect on February 1, 2015.

6 due to our unique offering of goods and value proposition, our market opportunities, we believe we have effectively tapped young people and teenagersteen markets.

According to US media reportsS.

According to the Census Bureau, the population of the United States between the ages of 5 and 19 exceeds 63 million, accounting for more than 20% of the population of the United States. S.

Population as of April 1, 2010.

Based on management experience and industry knowledge, we believe that this segment of the population has a significant amount of disposable income, as the vast majority of the basic needs of this age group have been met.

Our business strategy provides a dynamic, Editorial Classification of trendsright, high-

Top quality products, priced at $5 or less, including select brands and licensed items for teens and teensteen customer.

We believe that we are working through unique sales strategies and

Our customers see interesting and exciting energy retail concepts.

Based on management experience and industry knowledge, we believe that our compelling value proposition and the dynamic nature of our merchandise offerings have cultivated universal appeal to customers of various age groups outside the target population.

Our typical store has over 4,000 in stock

Keep units or SKUs in many of our category worlds including style, room, sports, technology, crafts, parties, candy and now.

Our sales strategy focuses on maintaining core categories in our stores, but the goal is to increase the speed of merchandise sales

By keeping our product range fresh and pushing for repeat access.

We monitor trends in the target population Market, Historical sales trends for current and previous products, and the success of new product launches to ensure that our goods are customer-related.

We have a highly planned trend-focused commodity strategy.

Increase traffic by choosing opportunistic purchases from our suppliers, thus providing our customers with an ongoing and exciting shopping experience, the right and everyday product.

We believe that we provide compelling value proposition for all core product categories.

The common element of our dynamic merchandise selection is the continuous delivery of superior value to consumers, and all products are available for $5 or less.

Pricing all items at $5 or less allows us to deliver an exciting range of products while maintaining the appeal of value retailers.

Many of the products we sell can also be found in store stores, department stores, commodity stores and pharmacies;

However, we offer all of these products for $5 and below in an exciting and easy-to-shop retail environment.

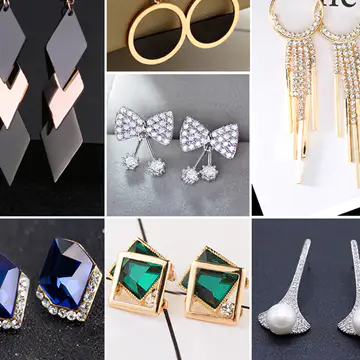

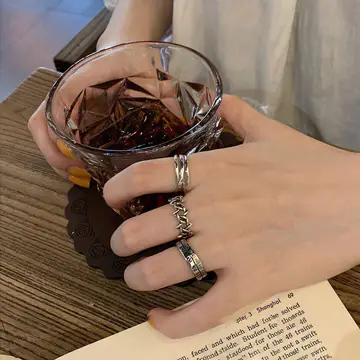

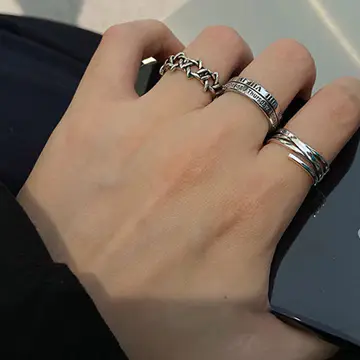

Product Portfolio we divide the items in our store into the following categories: Style: mainly composed of accessories such as novelty socks, sunglasses, jewelry, scarves, gloves, hair accessories, etc, top and bottom of the movement and \"attitude\" t-shirts.

Our beauty products include nail polish, lip gloss, perfume and branded cosmetics.

Room: includes items for completing and personalizing our client\'s living space, including Flash, poster, frame, wool blanket, plush items, pillows, candles, incense and related items.

We also offer storage options for the customer\'s room.

Sports: it consists of a variety of sports balls, team sporting goods and fitness accessories, including hand weight, rope skipping and fitness balls.

We also offer a wide range of games including branded board games, puzzles, collectibles and toys including remote controls.

Our sports products also include swimming pools, beach and outdoor toys, games and accessories during the summer months.

Technology: including various accessories for mobile phones, tablets, audio and computers.

The products include chassis, charger, headphones and other related products.

We also launched a range of media products including books, video games and DVDs.

Crafts: We offer a wide range of craft event kits as well as craft supplies such as crayons, markers and stickers.

We also offer trends

Suitable items for schools such as backpacks, fashion notebooks and magazines, novelty pens and pencils, and everyday designer items.

Party: consists of party supplies, decorations, gag gifts and greeting cards, and items for daily and special occasions.

7 candy: made up of brand goods that attract teenagers and teenagersteens.

This category includes a variety of classic and novel candy bars and movies

In addition to chewing gum and snacks, there are also large box candy.

We also sell frozen drinks through cooler.

Now: by seasonal-

Specific items used to celebrate and decorate activities such as Christmas, Easter, Halloween and ChristmasPatrick’s Day.

These products are most often placed in front of the store.

Data for the following groups of products are listed below-Leisure, fashion and home, parties and snacks.

The percentage of net sales per product group for the last three fiscal years is as follows: Percentage of Net Sales. 0%50. 8%51.

0 shion and home31. 2%29. 7%29.

3% Party and snack188%19. 5%19. 7%Total100. 0%100. 0%100.

0% Leisure includes items such as sporting goods, games, toys, technology, books, electronic accessories and handicrafts.

Fashion Home includes personal accessories, \"attitude\" t-

Shirts, beauty, household and storage are available.

Parties and snacks include items such as party and seasonal items, greeting cards, candy and other snacks, as well as drinks.

8 our store in January 28, 20:7, we run 522 stores in the northeast, south and central and western regions of the United States.

Our new store model assumes that the store area is about 8 000 square feet.

Our stores are mainly located in power, community and lifestyle shopping centers;

About 3% of our stores are located in the shopping center.

The map below shows the number of stores in each state we operate and the location of our distribution center, such as 2017.

Store design and layout we present our products in a unique way

Shop atmosphere.

We maintain a consistent floor layout with simple designto-

Navigation track flow and featured landscape-

The product line throughout the store enables customers to easily identify our category world.

All of our stores are equipped with sound systems to play pop music throughout the shopping day.

We use novel and dynamic technology to showcase our products, including unique commodity fixtures and colorful, stimulating signage that attract customers and encourage hands-on

Interact with our products and communicate our value pricing.

In addition to the traditional perimeter and basket shelves, shelves and tables, we also take advantage of innovative methods such as carts, barrels and bins strategically placed in our stores.

These technologies promote customer-to-product interactions, support our efforts to develop strong relationships with our customers, and enhance our optimistic and dynamic shopping environment.

In order to enhance the shopping experience of our customers, every category of our world is strategically located in our stores.

For example, our current product is located in front of the store in order to attract the attention of customers and become the \"most important person\", \"featured value items and other key items are placed along the central aisle.

There are impulse items and \"dollar value\" forms around the checkout area for additional informationon purchases.

9 expand opportunities and websites choose our unique focus on early teens and teens

Our real estate strategy supports young clients in high-

Visibility location.

We seek high-

High visibility-

Strengthen brand publicity, improve brand awareness, and promote traffic retail places for customer traffic.

Our strategy is to fill the market with a cluster of stores, because the stores have gained considerable benefits from market concentration.

Our shop model is in various cities, suburbs and half

Rural markets in multiple real estate sites including electricity, communities and lifestyle shopping centers.

Our retail philosophy works with a large and diverse group of countries

Tenants driving customer traffic.

We select shop locations where new stores are opened according to certain criteria, including minimum population density requirements, availability of attractive lease terms, sufficient space and strong positioning within the center.

Before making suggestions to our real estate board, members of our real estate team spent a lot of time evaluating potential locations.

Our Real Estate Board consists of senior management, including our executive officers, to approve all our locations before signing the lease.

We believe that it is an important opportunity to expand our store base in the United States.

We have opened 85 net new stores in fiscal2016, and we intend to open about 100 new stores in fiscal2016 by expanding and entering new markets in the existing market.

We maintain a range of real estate sites that have been approved by the real estate commission and performed 67 leases through January 28, 2017 for new stores in fiscal207.

A summary of our recent store growth is set out in the following table: PeriodStoresatStart ofperiodstoresopenedstoressuch as the periodnetstorestoresatend ofPeriodFiscal 201430462-

Opening stores in existing markets in fiscal 62366, fiscal 201536674371437, fiscal 201643786185522, has enabled the following five markets to benefit from increased brand awareness and achieve efficiency in advertising, operations and distribution.

We have targeted new stores, including opening more stores in the existing market and expanding new markets.

In the existing market, we use the store enhancement strategy to increase brand awareness and leverage marketing, operating and distribution costs.

When we entered the new market, we adopted the store cluster strategy to open multiple stores in one market on the same day, enabling us to take advantage of marketing and early stage

Brand awareness of the new market.

Our new store economy supports the growth of our stores, which we believe is convincing.

Our new store model assumes that the store area is approximately 8 000 square feet and sales are approximately $1.

During the first full year of operation, the average cash investment in new stores was about $0, at £ 6 million.

3 million, including the construction of our storesout (

Net tenant allowance), inventory (Net Accounts payableand cash pre-

Opening fee.

The goal of our new store model is that the average return period for our initial investment is less than a year.

Each of our stores is managed by one general manager and one or two assistant managers who oversee the wholetime and part-

Time Team members for each store.

Each general manager is responsible for each day-to-

The daily operation of the store, including the operation results of the unit, keeps the store environment clean and beautiful, and the recruitment, training and development of personnel.

We also hire regional managers who oversee the operations of our regional managers.

Our area managers are on average responsible for overseeing the operations of 10 to 15 stores.

The philosophy we follow is to recognize strong sales performance and customer service, allowing us to identify and reward team members who meet our high performance standards.

The manager and assistant manager participate in the reward program.

We also recognize individual performance through internal promotions and offer a wide range of promotion opportunities.

Our employees are essential to achieving our goals, and we strive to recruit talented and energetic employees. We have well-

Established store operation policies and procedures

Store training plan for new store manager, assistant store manager and employees.

In addition, we have a dedicated training team and a new store manager who focus on ensuring a consistent new store opening process, and use their extensive experience and knowledge of the following five cultures to train new store managers.

Our customer service and store program training program is designed to enable employees to help customers in a friendly way and to help create positive sales --

Promote the environment and culture and teach successful operational practices and procedures.

We have developed a disciplined buying method and dynamic inventory planning and distribution process to support our sales strategy.

Merchandising our merchandising team consists of an executive vice president of merchandising who reports directly to our CEO and is supported by a group of merchandising staff.

Our sales team works directly with our product development team and our central planning and distribution team to ensure consistent product delivery throughout our store.

Our executive vice president has over 30 years of experience in the retail industry.

Our product development team is led by senior vice president of business and product development.

Our product development team works directly with our sales team to identify new and improved products through international sourcing.

Our senior vice president of business and product development has over 30 years of experience in the retail industry.

We believe that through a dynamic partnership with our supplier partners, we have strong sourcing capabilities, which provide us with a favorable opportunity to obtain high-quality goods at attractive prices.

We regularly purchase core items according to our key categories.

We also adopt opportunistic buying strategies that take advantage of selected over-stock opportunities to purchase complementary goods based on consumer trends, product availability and favorable economic conditions.

We work with about 2016 active suppliers and none of them represent our annual purchase.

We purchased about 2016 of our products from 67% of our domestic suppliers.

We don\'t usually have a long time.

Enter into a long-term supply agreement or exclusive arrangement with our supplier.

Distribution we distribute over 700,000 of our goods from our distribution center of approximately 600,000 square feet located in Pedricktown, New Jersey, and our distribution center of approximately 85% square feet located in the olive branch of Mississippi, the remaining items are shipped directly from the supplier to our store.

We achieve cost savings by working with suppliers to simplify and reduce packaging and reduce transportation costs.

Depending on the season and the number of specific stores, we usually ship items from the distribution center to our store two to four times a week.

We use the contract carrier to ship the goods to our store.

From time to time, we expand our distribution facilities in a third way.

Party storage

We constantly assess how to maximize productivity and efficiency of existing distribution facilities and assess opportunities for additional distribution centers.

In June 2015, we opened a new distribution center in Pedricktown, New Jersey to support our expected growth.

We currently cover about 700,000 square feet in this distribution center and will expand to about 1 million square feet by 2019.

The lease agreement, which starts in fiscal 2015, will expire on 2025, with three options for renewal for five consecutive yearsyear periods.

Our cost marketing and advertising

Effective marketing strategies are designed to drive store traffic and increase brand awareness through our target population and other values

Customer oriented.

Our strategy includes the use of newspapers, television and digital advertising during the peak sales season, highlighting our brand and superior value proposition, as well as grassroots marketing to support existing and new market entry.

In addition, we rely on the strong visibility and influence of our store location, email messages and community fundraising to promote and enhance our brand image and drive traffic.

Our digital experience is based on our mobile e-commerce

As we leverage Facebook, Instagram, YouTube and Snapchat to attract customers to use compelling digital content every day, the presence of commercial websites and social media is growing rapidly.

11 our marketing team works with our sales team to develop novel and dynamic technologies to showcase our products, including unique commodity fixtures and colorful, engaging customers and encouraging hands-on,

Interact with our products and communicate our value pricing.

For the opening of the new store, we seek to create community awareness and consumer excitement through a mix of print and digital advertising, public relations and community outreach to promote grand opening and create an engaging grand opening event, including contest, giveaway and signature \"Five Cents\" hot dog.

We also aim to open multiple stores on a given new market on the same day in order to leverage marketing efforts to make the most impact.

In addition to the marketing and advertising work we described above, we also maintain e-commerce

Business website (www. fivebelow. com)

And, over the past year, our online followers have grown significantly.

We use our website and social networking sites to highlight our featured products, value proposition, store location, jobs and grand opening.

Competition we compete with a variety of retailers including discounts, mass goods, groceries, medicines, convenience, Variety and other specialty stores, which have both physical stores and online stores.

Many of these retail companies run stores in many areas we operate, many of which are engaged in extensive advertising and marketing work.

We are also competing with online retailers who do not have traditional physical stores.

The main basis for our competition is to provide a dynamic, edited variety of exciting products, all of which are priced at $5 or less, including selected brands and licensed goods, for teenagers and pre-teen customer.

We believe that we are working through unique sales strategies and

Our customers see interesting and exciting energy retail concepts.

Our success depends largely on our ability to respond quickly to trends so that we can meet the changing needs of our customers.

We believe that according to our sales strategy, we are advantageous relative to many competitors, and we have edited product categories for teenagers and teenagers

Environment, flexible real estate strategy and corporate culture.

Still, some of our competitors have more financial, distribution, marketing and other resources than we do.

Trademarks and other intellectual property rights. we have several trademarks registered in the United States. S.

Patent and Trademark Office, including the following five®And five hot things down there. Cool Prices®.

We also have our own domain names, including www. fivebelow.

And copyright not registered in the content of our website.

We try to obtain trademark registration where practicable and conduct any infringement of these trademarks.

For convenience only, the trademarks and trade names mentioned in this document can be®Or™Symbols, but this reference does not intend to show in any way that, under applicable law, we will not assert to the greatest extent that our rights to these trademarks and trade names or the rights of the applicable licensors.

We also refer to the product name, trademark and service mark of the property of other companies.

The management information system provides a full range of business process assistance and timely information to support our sales strategy, warehouse management, store and operations and finance team.

We believe that our current system provides us with operational efficiency, scalability, management control, and timely reporting, enabling us to identify and respond to sales and operational trends in the business.

We use a combination of internal and external resources to support store points-of-

Functions such as procurement, inventory management, financial reporting, real estate, human resources, administrative management, etc.

We constantly assess how to maximize productivity and efficiency and assess opportunities to further enhance existing systems.

We are subject to labor laws, advertising laws, privacy laws, safety regulations and other laws, including consumer protection regulations that regulate the promotion and sale of goods by retailers and/or manage the operation of store and warehouse facilities.

We monitor changes in these laws and believe that we are substantially complying with the applicable laws.

We maintain third-

Party insurance for some risk management activities including, but not limited to, workers\' compensation, networks, directors and officials, general liability, property and employees

Related medical benefits.

We constantly evaluate our insurance requirements to ensure that we maintain adequate levels of coverage.

We employ 2017 employees, about 800.

Time and part 700time personnel.

Of our total number of employees, about 300 are located at our corporate headquarters in Philadelphia, Pennsylvania, and about 200 are located at our distribution centers in Pedricktown, New Jersey, and the Mississippi olive branch, 000 are store employees.

Quantity of parts-

Time partners fluctuate according to seasonal demand.

None of our employees belong to the Union or to a party to any collective bargaining or similar agreement.

SeasonalityOur business is essentially seasonal, with the highest net sales and net income in the fourth quarter due to this year\'s reasons

The end of the holiday, therefore, the results of the operation of any fiscal quarter do not necessarily indicate the results of the entire fiscal year.

In order to prepare for the holiday, we have to order and store more items than we carry in other parts of the year.

We expect inventory levels, as well as an increase in accounts payable and accrued charges, to typically reach the highest level in the third and fourth fiscal quarters, as net sales are expected to increase this year --

The holiday is over.

Due to this seasonality, usually due to changes in consumer consumption habits, we experienced fluctuations in net sales, net income and working capital demand over the course of the year.

For more information about us, please visit our website atwww. fivebelow. com.

The content of our website is not part of the form 10 annual reportK.

Electronic documents we submit to the Securities and Exchange Commission (

Including all annual reports on Form 10

Quarterly Report on table 10

Q and Current Report on Table 8

K, and any amendments to these reports)

Including exhibits, after we submit or provide them electronically to the Securities and Exchange Commission, we will provide them free of charge through our website as soon as reasonably practicable. ITEM 1A.

Risk factors when reading this year\'s report, you should carefully consider the following risks and uncertainties.

If any of the following risks actually occur, our business, financial position and results of operations may be materially adversely affected.

In this case, the transaction price of our common stock may decline.

While we believe that we have identified and discussed the key risk factors that affect our business below, additional risks and uncertainties that are not currently known or currently considered unimportant may adversely affect our performance or financial position.

Risks associated with our business and industry we may not be able to successfully implement our growth strategy in a timely or fundamental manner, which may compromise our growth and operational results.

Our growth depends on our ability to open profitable new stores.

We believe that over time we have the opportunity to continue to expand our store base from 5 22 stores in 31 states to more than 2017.

Our ability to open profitable new stores depends on many factors, including our ability to identify the right market and location for new stores;

Negotiating leases on acceptable terms;

Achieve brand awareness in the new market;

Procurement and distribution of additional goods effectively;

Maintain sufficient capacity for distribution, information systems and other operating systems;

Hire, train and retain store management personnel and other qualified personnel;

Achieve sufficient cash flow and financing levels to support our expansion.

13 There is no attractive store location, delays in the acquisition or opening of new stores, delays or costs due to reduced commercial development due to capital constraints, difficulties in staffing and operating new store locations or insufficient customer acceptance of new market area stores may have a negative impact on our new store growth and new store-related costs or profitability

In addition, some of our new stores may be located in areas where we are inexperienced or lack brand recognition.

These markets may have different competitive conditions, market conditions, consumer tastes and discretionary consumption patterns compared to our existing markets, which may lead to these new stores being inferior to our existing markets

Other new stores may be located in the area of our existing stores.

Although we have experience in these markets, increasing the position of these markets may lead to an inadvertent excess

The market is saturated, temporarily or permanently shifting customers and sales from our existing stores, adversely affecting our overall financial performance.

Therefore, we cannot assure you that we will achieve our planned growth or that any new store will operate as planned even if we are able to expand our store base as planned.

If we fail to successfully implement our growth strategy, we will not be able to sustain the rapid growth of our expected sales and profits, which may adversely affect our common stock prices.

Our ability to choose, acquire, distribute and sell goods that are attractive to our customers is subject to any disruption that enables us to sell them at profitable prices, all of which can have a negative impact on our business

We are usually able to choose and obtain a sufficient number of attractive items at a price that can be profitable.

If we cannot continue to choose products that are attractive to our customers and obtain them at cost, so that we can sell them in a profitable way, or in order to effectively market these products to consumers, our sales or profitability may be adversely affected.

In addition, the success of our business depends to a certain extent on our ability to predict, identify and respond quickly to changing trends in demographics and consumer preferences, expectations and needs.

If we are not able to respond quickly to development trends, or if there is a change in consumption patterns or demographics in these markets, we are also not able to respond to such changes in a timely and appropriate manner, and then, the demand for our products is discretionary and our market share may be adversely affected.

Failure to maintain attractive stores, failure to discover or effectively respond to changing consumer needs, preferences and consumption patterns in a timely manner, may have an impact on our relationship with our customers, on our products and on US

Any disruption to our supply of goods or an increase in prices can have a negative impact on our ability to achieve the expected operating results.

The products we sell come from various suppliers at home and abroad.

We have not encountered any difficulties in obtaining a sufficient number of core commodities, and we believe that if one or more of our current supply sources becomes unavailable, we are usually able to obtain alternative sources without experiencing serious business disruptions.

However, this alternative source may increase the cost of our goods, reduce the quality of our goods, and the inability to obtain alternative sources may affect our sales.

Our dependence on goods produced outside the United States puts us at legal, regulatory, political and economic risk.

Most of our goods are manufactured outside the United States, and changes in the price and flow of these goods may adversely affect our operations.

The United States and other countries have occasionally introduced and enacted protectionist trade legislation, which may lead to changes in tariff structures, trade policies and restrictions, thereby increasing costs or reducing the supply of certain commodities.

In particular, the recent political discussions in the United States have increasingly focused on the implementation of protectionist trade policies.

The tax proposal may include changes that adversely affect us, including \"border adjustment tax\" or new import tariffs, which may adversely affect us, because the products we sell are mainly made outside the United States.

It was also suggested that the United States could make substantial changes or withdraw from some of its existing trade agreements.

Any of these or other measures, if finally promulgated, or events relating to the manufacturer of our goods and the country in which it is located, some or all of which are beyond our control, it will adversely affect our ability to obtain suitable goods on acceptable conditions, adversely affect our operations, increase costs and reduce profits.

These events or circumstances include, but are not limited to, political and economic instability;

Financial instability and labor problems of our commodity manufacturers;

Supply and cost of raw materials;

Quality or safety of goods;

Change in currency exchange rate;

14 The regulatory environment in the country where our commodity manufacturers are located; inflation;

And the availability, cost and disruption of transport.

These and other factors that affect the manufacturer of our goods and the opportunities we have to acquire our products may adversely affect our financial performance.

Our sales depend on the traffic in our store and the traffic that is reduced or closed, and the main tenants and other destination retailers in the shopping center where our store is located may greatly reduce our sales, and leave us extra stock.

Most of our stores are located in power, community and lifestyle shopping centers and benefit from the ability to \"anchor\" retail tenants, often large box shops, and other destination retailers and attractions, generate enough consumer traffic near our store.

Any decline in consumer traffic in shopping centers, whether due to consumer preferences for shopping on the Internet or shopping in large warehouse stores, a slowdown in the economy and a decline in popularity in shopping centers, the closure of anchor stores or other destination retailers may lead to a decrease in sales in our stores, leaving us with excess inventory, which may have a significant adverse effect on our financial results or business.

Failure to attract and retain qualified employees, lack of control over labor costs and other labor issues can adversely affect our business.

Our growth may be adversely affected by the inability of the store operations level, distribution facilities and company level to attract, retain and motivate qualified employees, allowing us to make a profit in our operations.

Our ability to meet labor demand while controlling labor costs is affected by many external factors, including competition and availability of qualified personnel in specific markets, unemployment rates in these markets, changes in current wage rates, minimum wage laws, health and other insurance costs, employment and labor laws (

Including changes in the process of our employees joining the Union)

Or other workplace regulations.

For example, some jurisdictions we operate have historically enacted minimum wages that exceed federal standards.

If our competitors increase the rate of pay for our employees, we may have to increase the rate of pay to stay competitive and attract and retain our employees, which will increase our labor costs.

If we do not maintain a competitive salary, our customer service may be affected by the decline in the quality of the labor force, or, if we increase the rate of pay, our income may be reduced.

Also, if a large part of our staff base joins the Union, or tries to join the Union, our labor costs may increase.

In addition, we believe that our current pricing of medical expenses includes the potential future impact of the Patient Protection and Affordable Care Act, but such legislation may further lead to an increase in our medical expenses

Significant costs of the Patient Protection and Affordable Care Act may occur, because the provisions of the legislation will be implemented step by step over time, and changes in our medical cost structure may occur

In addition, our ability to pass any increase in labor costs to our customers is limited by our low-cost model.

Our new store growth depends on our ability to successfully expand distribution network capacity, and failure to implement or maintain these plans may adversely affect our performance.

We have distribution centers in Pedricktown, New Jersey, and olive branches in Mississippi.

We constantly assess how to maximize productivity and efficiency of existing distribution facilities and assess opportunities for additional distribution centers.

In fiscal 2015, we opened a new distribution center in Pedricktown, New Jersey to support our growth goals.

We currently cover about 700,000 square feet and will expand to about 1 million square feet by 2019.

Delays in expanding this distribution center (

Or a new distribution center in the future)

This may slow down the growth of the store and, in turn, reduce the growth of sales, thus adversely affecting our future operations.

In addition, any distribution-

The associated construction or expansion projects are at risk of delays and cost overruns, such as: material shortages;

Shortage or stoppage of skilled labor;

Unforeseen construction, scheduling, engineering, environmental or geological problems;

Weather disturbance;

Loss of fire or other casualties;

Unexpected cost increases.

Completion date and final cost of future projects, including planned future expansion of Pedricktown, distribution center, New Jersey (

Or a new distribution center in the future)

Due to construction, it may be very different from the original expectation

Related or other reasons.

We cannot guarantee that any project can be completed on time or within the established budget.

Significant disruption to our distribution network or timely receipt of inventory may adversely affect sales, or increase our shipping costs, thereby reducing our profits.

Because most of our products come from our distribution center, the accidental loss of any of our distribution centers due to natural disasters or other reasons will have a significant impact on our operations.

We also rely on independent third parties.

Party shipping to our store in time for goods

It is an effective way by delivering it to our distribution center from the supplier and then shipping it from the distribution center or directly to our store.

Our use of external delivery services when shipping is affected by risks beyond our control, and any disruption, unexpected charges or operational failures associated with this process can have a negative impact on store operations.

For example, an unexpected delay or increase in transportation costs (

Including increasing fuel costs or reducing transportation capacity for overseas transport, or due to labor shortages or downtime)

It will greatly reduce our ability to create sales and make profits.

If we change the shipping line, we may face logistics difficulties, which may adversely affect the delivery, we will pay the cost and consume the resources for this.

In addition, we may not be able to obtain the same preferential terms as those obtained from independent third parties

The third party shipping providers we currently use increase our costs.

Extreme weather conditions in the area where our store is located can have a negative impact on our business and operational results.

Extreme weather conditions in the area where our store is located can have a negative impact on our business and operational results.

We have a large number of stores in the Northeast and Midwest of the United States that are vulnerable to bad weather conditions and severe storms.

This bad weather can have a significant impact on consumer behavior, travel and store traffic patterns, and our ability to run our stores.

For example, frequent or unusually strong snowfall, ice storms, long downpours or other extreme weather can make it difficult for our customers to visit our store, thus reducing our sales and profitability.

In addition, we usually generate higher revenue and gross profit margin in the fourth fiscal quarter (including this year)

The holiday is over.

If weather conditions are not good during this period, our operating results and operating cash flow may be adversely affected.

If we are unable to protect the confidential or credit card information of our customers, or other private data related to our employees or the company, we may be negatively promoted, expensive government enforcement actions or private lawsuits may harm our business reputation and adversely affect our financial results.

Protecting our customers, employees, and company data is critical to us.

We have procedures and techniques to protect customer debit and credit cards as well as other personal information, employee private data and company records, and intellectual property rights.

While we have taken important measures to protect customers and confidential information, deliberate or negligent actions by employees, business partners or third parties may undermine our security measures.

Therefore, unauthorized parties may access our data system and inappropriate confidential data.

There is no guarantee that advances in computer capabilities, new discoveries in the field of cryptography, or other developments will prevent the compromise of our customers\' transaction processing capabilities and personal data.

In addition, since technologies used to obtain unauthorized access, disable or downgrade services or disrupt systems often change, and are often not recognized until the target is launched, we may not be able to predict these technologies, adequate precautions cannot be implemented.

If any such compromise occurs with our security or with the security of information residing with our business partners or third parties, we may be affected by negative publicity, government enforcement actions, private litigation or costly response.

In addition, our reputation in the business world and among our customers may be affected, which may cause our customers to stop using debit cards or credit cards in our stores, or to shop completely out of our stores.

Annual Report submitted under Section 13 or 15 (d)

Pursuant to section 13,15, the Securities Trading Act or transition report for the fiscal year 1934 ended January 28, 2017 (d)

Provisions of the Securities Trading Act of 1934 on the transition period from tocommsion File Number: 001-

Below 35600, the company(

The exact name of the registrant specified in the articles of association)Pennsylvania75-3000378(

State or other jurisdiction of company or organization)(I. R. S.

Employee Identification Number)

1818 Market Street suites 2000 Philadelphia, PA 19103 (

Main executive office address)19103(Zip Code)(215)546-7909(

Registrant phone number, including area code)

Securities registered under article 12 (b)

The trading act: the title of each class name of each exchange registered with common stock, $0.

01 Nasdaq Stock Market LLCSecurities registered under section 12th (g)

Securities trading law: the person who changed the check mark of registeredNot appliclenot applicableIndicate for each topic is

Well-known experienced issuers as defined in Rule 405 of the Securities Act.

Is it not necessary to submit a report under Section 13 or section 15 (d)of the Act.

Indicate by check mark whether the registrant (1)

All reports requested by Article 13 or 15 have been submitted (d)

Securities Trading Act of 1934 within the first 12 months (

Or a short period of time required for the registrant to submit such reports), and (2)

This filing requirement has been bound for the last 90 days.

Indicate by check mark whether the registrant has electronically submitted and posted on his company\'s website, if any, every interactive data submitted and posted under S-Regulation section 405thT (§232.

This Chapter 405)

Within the first 12 months (

Or in such a short time that the registrant is required to submit and publish these documents).

Disclosure under S-Regulation section 405th whether the declarant in arrears is indicated by a check markK (§ 229. 405)

As the registrant is aware, it is not included here and will not be included in the final proxy or information statement referenced in Part 3 of this form --

K or any amendments to this form 10K.

Indicate by check mark whether the registrant is a large accelerated declarant, a non-accelerated declarant

A smaller reporting company.

See the definition of \"large accelerated file manager\", \"accelerated file manager\" and \"small Reporting Company\" in rule 12b

2 of the Trading Act. (Check one)

: Non-accelerated files for big acceleration

Indicate whether the registrant is a shell company by check mark (

Defined in Rule 12b-

2 parts of the transaction law).

On July 29, 2016, the last working day of the second fiscal quarter recently completed by the registrant, the total market value of ordinary shares (

According to the last reported sales price on Nasdaq\'s Global Select Market)held by non-

The registrant\'s affiliates are approximately $2,449,890,478.

The number of shares of the registrant\'s common stock, $0.

The face value of 01 was 930,387 outstanding as of March 22, 2017.

Documents incorporated in the reference section of the registrant\'s proxy statement for the 2017 General Meeting of Shareholders held in june20 on 2017 (

Hereinafter referred to as \"agency Statement \")

Included as a reference in part III of this report.

Special note on forwarding

Annual Report on Form 10

The annual report contains forward-looking

Statements are made under the \"safe harbor\" provisions of the Private Securities Litigation Reform Act of 1995. Forward-

Forward-looking statements relate to expectations, beliefs, forecasts, future plans and strategies, anticipated events or trends, and similar expressions of matters concerning non-historical facts or current facts or conditions, for example, statements about our future financial position or results of operations, prospects and strategies for our future growth, the launch of new goods, and the implementation of our marketing and brand strategy.

In many cases, you can identify the forward

Statements in terms such as \"possible\", \"will\", \"should\", \"expected\", \"plan\", \"expected\", \"believe\", \"estimate, \"Prediction\", \"potential\" or negation of these terms or other similar terms. The forward-

The forward-looking statements in this annual report reflect our views on future events and are affected by risks, uncertainties, assumptions and changes that may cause events or our actual activities or results to be significantly different from the assumptions and situation changes expressed in any forwarding

Statement.

Despite our belief, the expectations reflected in the future

We cannot guarantee future events, results, actions, level of activity, performance or achievements.

Many important factors may lead to significant differences in actual results from the results indicated previously

Part I, Item 1A, \"risk factors\" and forward-looking statements described in Part II, including, but not limited to, the following factors, Item 7 \"Management\'s Discussion and Analysis of the financial position and results of operations.

These factors include but are not limited to: failure to implement our growth strategy successfully;

Our ability to select, acquire, distribute and sell goods is disturbed;

Dependent on goods produced outside the United States;

Depends on the passenger flow of our store;

Failure to attract and retain qualified employees;

The capacity of our distribution network cannot be expanded successfully;

Our distribution network breaks down or receives inventory in a timely manner;

Extreme weather conditions in the area where our store is located may have a negative impact on our business and operational results;

Failure to protect the client\'s confidential or credit card information, or other private data relating to our employees or the company;

Increased operating costs due to customer payments or face fraud or theft-related risks;

Unable to increase sales and increase efficiency, cost and efficiency of operations;

Reliance on or inability to employ additional qualified personnel for our executives, senior management and other key personnel;

Unable to manage our inventory balance and inventory shrinkage successfully;

Our lease obligations

Changes in our competitive environment, including increased competition from other physical retailers and online retailers;

Increased costs due to inflation, increased operating costs, higher wage rates or higher energy prices;

Seasonal nature of our business;

Unable to successfully expand our business to online retail;

Interrupt our information technology system during normal process or due to system upgrade;

Insufficient internal control is not maintained;

The complexity of the design or implementation of new enterprise resource systems;

Natural disasters, bad weather, outbreak of pandemic diseases, global political events, war and terrorism;

Current Economic Situation and other economic factors;

Influence of government laws and regulations;

Costs and Consequences of legal proceedings;

We cannot protect our brands, trademarks and other intellectual property rights;

Effects of product and food safety claims and effects of legislation;

Additional financing is not available if required;

The constraints that our debt imposes on our current and future business;

Regulations related to conflict minerals.

In assessing the future, readers are urged to consider these factors carefully

Forward-looking statements and are warned not to rely too much on them

Look at the report.

All the strikers.

The forward-looking statements we include in this annual report are based on the information provided on the date of this report.

We have no obligation to update or modify any forwarding publicly-

Forward-looking statements, whether due to new information, future events or other reasons, unless otherwise required by law.

Index part IPageITEM 1.

Business 1A.

Risk factor 1B.

Unresolved employee reviews 2.

Property item month.

Legal action 4.

The third part is the fifth mine safety disclosure.

Market for registrant common stock, related shareholder matters and issuer to purchase equity securities

Selected Financial Data Items 7.

Management\'s Discussion and Analysis of operating conditions and results

Quantitative and qualitative disclosure of market risks

Consolidated financial statements and supplementary data item 9.

Changes and disagreements with accountants on accounting and financial disclosure project 9A.

Control and procedure 9B.

Section IIIITEM 10 of other information.

Project 11. Director, executive officer and corporate governance.

Item 12 of administrative compensation.

Secured ownership of certain beneficial owners and management and related shareholders.

Relationship with directors and related transactions.

Main accounting fees and services section IVITEM 15.

Annex and schedule 16 to the financial statements. FORM 10-

Item ysignaturespart IITEM 1.

The following companies

Founded in Pennsylvania in January 2002.

Our main executive office is located at 1818 Market Street, PA 2000 suite 19103, Philadelphia, and our telephone number is (215)546-7909.

The address of our company website isfivebelow. com.

Information contained on or accessible through our company\'s website does not form part of this annual report.

As described in this article, \"the following five\", \"company\", \"our\" or \"our business\" refer to the following five companies(

Co-owned with wholly owned subsidiaries)

, Unless explicitly indicated or otherwise required by context.

We buy products based on existing market trends, so call our products \"trend-right.

\"We use the term\" dynamic \"merchandise to refer to the wide range and often changing nature of the products we display in the store.

We use the term \"electric power\" mall to refer to a shopping mall that is not closed and has a total area of 250,000 to 750,000 square feet of rentable

Large retailers with an area of over 50,000 square feet)

A variety of small retailers sharing a parking lot with retailers.

We use the term \"lifestyle\" shopping center to refer to a shopping mall or business development that is usually located in the suburbs, which combines the traditional retail functions of the shopping center with the high-end consumers.

We use the term \"community\" shopping center to refer to a shopping district that is designed to serve a trade zone of 40,000 to 150,000 people, with major tenants enjoying various discounts, junior department stores and/or supermarkets.

We use the term \"trade zone\" to refer to the geographic area from which most customers of a given retailer come from.

The trade area varies depending on geographical area, population density, population structure and other shopping opportunities nearby.

We run on the financial calendar that is widely used in the retail industry, which leads to-or 53-

Closest to the week ending on Saturday, January 31 of the following year.

\"Fiscal Year 2017\" or \"Fiscal Year 2017\" refers to the period from January 29-20, 2017 to February 3, including 53-

Fiscal year week

\"Fiscal Year 2016\" or \"Fiscal Year 2016\" refers to the period from January 31-20, 2016 to January 28, including 52-

Fiscal year week

\"Fiscal Year 2015\" or \"Fiscal Year 2015\" refers to the period from February 1-20, 2015 to January 30, including 52-

Fiscal year week

\"Fiscal Year 2014\" or \"Fiscal Year 2014\" refers to the period from February 2-20, 2014 to January 31, including 52-

Fiscal year week

\"Fiscal Year 2013\" or \"Fiscal Year 2013\" refers to the period from February 3-20, 2013 to February 1, including 52-

Fiscal year week

\"Fiscal Year 2012\" or \"Fiscal Year 2012\" refers to the period from January 29-20, 2012 to February 2, including 53-

Fiscal year week

Unless otherwise stated, the references to 2016, to, in, to, twitter 3, and 12 are our fiscal year.

Below 5 of our company is a fast-growing professional value retailer that offers a wide range of trendsright, high-

Quality goods for teenagers and teenagersteen customer.

We offer a variety of exciting products at a price of $5 and below, including selected brands and licensed goods in our many categories of the world: style, room, sports, technology, crafts, parties, candy and now.

We believe that we are working through unique sales strategies and

Our customers see interesting and exciting energy retail concepts.

Based on management experience and industry knowledge, we believe that our compelling value proposition and the dynamic nature of our products cultivate the universal appeal of adolescents and adolescents

In addition to our target population, teenagers and customers in various age groups.

In 2002, we opened the first of the following five stores in the greater Philadelphia area, and since then we have been expanding in the northeastern, southern, and central and western parts of the United States.

As of 2017, we have operated a total of 5 22 locations in 31 states.

Our new store model assumes that the store area is approximately 8 000 square feet and is usually located within the power, community and lifestyle shopping centers in various cities, suburbs and semi-suburbsrural markets.

We have opened 85 new net stores in fiscal2016 and are planning to open about 100 new stores in fiscal207.

We believe that over time we have the opportunity to expand our store base to more than 2 thousand locations.

In August 2016, we started selling goods on the Internet through our fivebelow. com e-

Business website.

We launched our electronics.

Business operations as an additional channel to serve our customers.

We believe that our business model brings strong financial performance regardless of the economic environment: our comparable sales have tripled.

0% in fiscal, 2016, 3.

4% in fiscal2015, and3.

4% in fiscal204.

We expanded our store base from 36 stores at the end of the fiscal year to 5 stores at the end of the fiscal year, which represents a compound annual growth rate of 19 years. 4%.