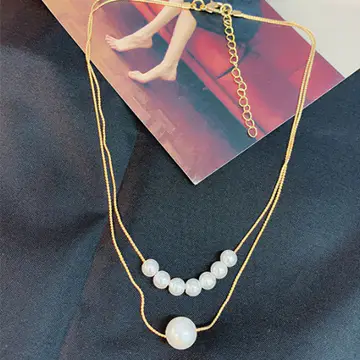

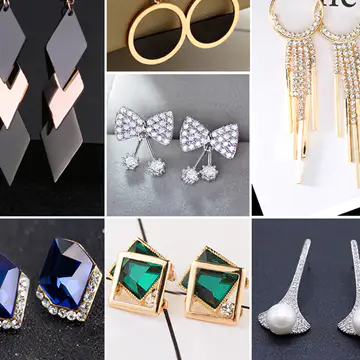

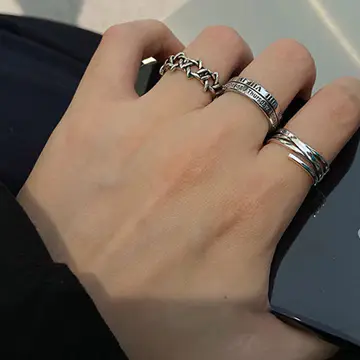

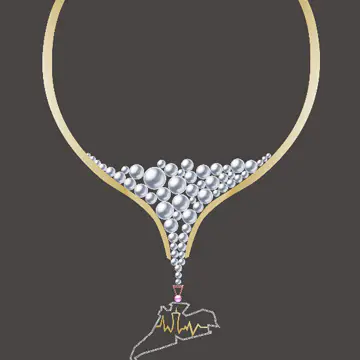

工厂介绍

rising raw prices to hurt luxury margins

by:Keke Jewelry

2020-06-02

PARIS (Reuters)-

Record high prices for raw materials such as gold, silver, diamonds, leather and cashmere will squeeze profits from luxury manufacturers this year as rising prices will only absorb some of the losses.

With the acceleration of global economic recovery, the growth of emerging market economies such as China is accelerating, commodity prices are spiraling, and the cost of enterprise investment is rising.

Precious metal prices, seen as alternative investments, have soared with the support of weak U. S. S.

Dollar and low interest rates.

Other raw materials, such as leather, cotton or cashmere, become scarce due to high demand in Asia.

Fund manager Scilla Huang Sun said at Reuters\'s global luxury goods and fashion summit: \"The company is worried about high raw materials and production costs . \".

\"In the luxury sector, however, high raw material prices will have less impact than other consumer companies, as they account for a smaller proportion of the cost base.

Comfortable gross margin of 55

75%, production is mainly located in Europe, where wages will not surge as much as in China, and strong pricing capabilities provide some shelter for luxury groups to withstand cost pressures, Huang Sun said, he manages a luxury fund in Switzerland and global asset management.

Gold rose nearly 40% in a year, hitting a record high of more than $1,575 an ounce at the beginning of the year, but has since fallen as the US economy recovers. S.

The currency rebounded from a low point, the dollar-

Higher priced goods for other currency holders.

At the end of April, the average price of certified polished diamonds was 19.

Diamond entrepreneur Martin Rapaport\'s benchmark price list shows the price is up 6% from the same period last year.

\"I think diamond prices will continue to rise until interest rates rise,\" Rapaport said in an interview with Reuters . \".

Higher interest rates have prompted diamond cutters to sell more stones, thus increasing market supply while they seek to reduce inventory costs, while also making consumers more cautious about consumption, it also gives potential diamond investors a good reason to keep the money in the bank.

Jean-\"high raw material costs hurt our profits because you can\'t raise the price every time the input costs go up

Marc Jacobs, head of Parmigiani, a senior watch maker, said at a summit in Paris.

\"For Parmigiani, these costs have doubled over the past two to three years.

However, Jacot says wealthy Chinese and Russians are ready to relax their wallets. quality items.

A study by McKinsey & Co, a management consulting firm, shows that 28% of people in China are willing to pay full prices for luxury goods, compared with 6% in Europe and 9% in the United States.

Harry Winston Diamond, North American jewelry retailer

Color Stone is said to be more and more popular among Chinese consumers.

\"Because the price of white diamonds is too high, I believe they are starting to like colored diamonds as a replacement, it can have good sales at a moderate price, Frederic de Narp, chief executive officer of the company) said at the summit in New York.

He said Harry Winston benefited from soaring diamond prices for holding a 40% stake in a diamond mine. Mid-

Jewelry manufacturers and watchmakers whose customers are more expensive

Sensitive, may find it harder to raise prices and will consider other solutions, including the use of cheaper materials.

Although the price of silver has almost doubled over the past year to a record high of $49.

51 an ounce later last month.

Expensive metal can replace gold in some jewelry.

Gianluca Brozzetti, CEO of Italian fashion company cavalcavalli, said at the summit: \"As gold prices rise, I think silver jewelry will usher in a new season in the market.

The Italian Goldsmith tried Gold.

Even in the premium market, silver jewellery and silver collections have been introduced to mitigate the impact of metal prices on consumers.

Fashion and accessories manufacturers have had to deal with rising prices for cotton, cashmere and leather.

Thierry Gillier, founder and owner of fashion brand Zadig & Voltaire, said demand for cashmere was strong and he expected prices not to drop soon.

\"This is not a problem at the moment.

\"Our profit margin is big enough to absorb that,\" he said . \" He added that he is working to keep prices stable.

Leather prices are also rising.

Chief Executive Officer of Hermes (HRMS. PA)

Patrick Thomas told Reuters earlier this month that the prices of all kinds of leather used by luxury goods groups rose by an average of 10% last year.

Changes in Western European eating habits may be one of the reasons why the most popular calf in luxury handbags has become scarce.

\"The leather factory uses waste products from the meat industry.

Nowadays, people eat less veal, so these skins are hard to buy, \"said Stefano Giannotti, manager of Italian leather agent Fargo.

He also said China, which used to export raw skin, has now become an importer.

As Chinese farmers leave the countryside for cities, domestic demand for skin has increased and production has declined.

Brozzetti of Cavalli said that the sharp increase in accessories consumption has caused leather procurement problems.

\"Some of the biggest participants are buying leather companies to make sure they get the supply of the materials they need,\" he said . \".

Record high prices for raw materials such as gold, silver, diamonds, leather and cashmere will squeeze profits from luxury manufacturers this year as rising prices will only absorb some of the losses.

With the acceleration of global economic recovery, the growth of emerging market economies such as China is accelerating, commodity prices are spiraling, and the cost of enterprise investment is rising.

Precious metal prices, seen as alternative investments, have soared with the support of weak U. S. S.

Dollar and low interest rates.

Other raw materials, such as leather, cotton or cashmere, become scarce due to high demand in Asia.

Fund manager Scilla Huang Sun said at Reuters\'s global luxury goods and fashion summit: \"The company is worried about high raw materials and production costs . \".

\"In the luxury sector, however, high raw material prices will have less impact than other consumer companies, as they account for a smaller proportion of the cost base.

Comfortable gross margin of 55

75%, production is mainly located in Europe, where wages will not surge as much as in China, and strong pricing capabilities provide some shelter for luxury groups to withstand cost pressures, Huang Sun said, he manages a luxury fund in Switzerland and global asset management.

Gold rose nearly 40% in a year, hitting a record high of more than $1,575 an ounce at the beginning of the year, but has since fallen as the US economy recovers. S.

The currency rebounded from a low point, the dollar-

Higher priced goods for other currency holders.

At the end of April, the average price of certified polished diamonds was 19.

Diamond entrepreneur Martin Rapaport\'s benchmark price list shows the price is up 6% from the same period last year.

\"I think diamond prices will continue to rise until interest rates rise,\" Rapaport said in an interview with Reuters . \".

Higher interest rates have prompted diamond cutters to sell more stones, thus increasing market supply while they seek to reduce inventory costs, while also making consumers more cautious about consumption, it also gives potential diamond investors a good reason to keep the money in the bank.

Jean-\"high raw material costs hurt our profits because you can\'t raise the price every time the input costs go up

Marc Jacobs, head of Parmigiani, a senior watch maker, said at a summit in Paris.

\"For Parmigiani, these costs have doubled over the past two to three years.

However, Jacot says wealthy Chinese and Russians are ready to relax their wallets. quality items.

A study by McKinsey & Co, a management consulting firm, shows that 28% of people in China are willing to pay full prices for luxury goods, compared with 6% in Europe and 9% in the United States.

Harry Winston Diamond, North American jewelry retailer

Color Stone is said to be more and more popular among Chinese consumers.

\"Because the price of white diamonds is too high, I believe they are starting to like colored diamonds as a replacement, it can have good sales at a moderate price, Frederic de Narp, chief executive officer of the company) said at the summit in New York.

He said Harry Winston benefited from soaring diamond prices for holding a 40% stake in a diamond mine. Mid-

Jewelry manufacturers and watchmakers whose customers are more expensive

Sensitive, may find it harder to raise prices and will consider other solutions, including the use of cheaper materials.

Although the price of silver has almost doubled over the past year to a record high of $49.

51 an ounce later last month.

Expensive metal can replace gold in some jewelry.

Gianluca Brozzetti, CEO of Italian fashion company cavalcavalli, said at the summit: \"As gold prices rise, I think silver jewelry will usher in a new season in the market.

The Italian Goldsmith tried Gold.

Even in the premium market, silver jewellery and silver collections have been introduced to mitigate the impact of metal prices on consumers.

Fashion and accessories manufacturers have had to deal with rising prices for cotton, cashmere and leather.

Thierry Gillier, founder and owner of fashion brand Zadig & Voltaire, said demand for cashmere was strong and he expected prices not to drop soon.

\"This is not a problem at the moment.

\"Our profit margin is big enough to absorb that,\" he said . \" He added that he is working to keep prices stable.

Leather prices are also rising.

Chief Executive Officer of Hermes (HRMS. PA)

Patrick Thomas told Reuters earlier this month that the prices of all kinds of leather used by luxury goods groups rose by an average of 10% last year.

Changes in Western European eating habits may be one of the reasons why the most popular calf in luxury handbags has become scarce.

\"The leather factory uses waste products from the meat industry.

Nowadays, people eat less veal, so these skins are hard to buy, \"said Stefano Giannotti, manager of Italian leather agent Fargo.

He also said China, which used to export raw skin, has now become an importer.

As Chinese farmers leave the countryside for cities, domestic demand for skin has increased and production has declined.

Brozzetti of Cavalli said that the sharp increase in accessories consumption has caused leather procurement problems.

\"Some of the biggest participants are buying leather companies to make sure they get the supply of the materials they need,\" he said . \".

Custom message